What is bitcoin?

What is bicoin?

“Classic money definition: A medium that can be exchanged for goods and services and is used as a measure of their values on the market, including among its forms a commodity such as gold, an officially issued coin or note, or a deposit in a checking account or other readily liquefiable account.”

“Fiat money: Money which has no intrinsic value and cannot be redeemed for specie or any commodity, but is made legal tender through government decree. All modern paper currencies are fiat money, as are most modern coins. The value of fiat money depends on the strength of the issuing country’s economy. Inflation results when a government issues too much fiat money.”

“Cryptocurrency (or crypto currency): is digital asset designed to work as a medium of exchange that uses strong cryptography to secure financial transactions, control the creation of additional units, and verify the transfer of assets. Cryptocurrency is a kind of digital currency, virtual currency or alternative currency. Cryptocurrencies use decentralized control as opposed to centralized electronic money and central banking systems. The decentralized control of each cryptocurrency works through distributed ledger technology, typically a blockchain, that serves as a public financial transaction database. -Wikipedia- ”

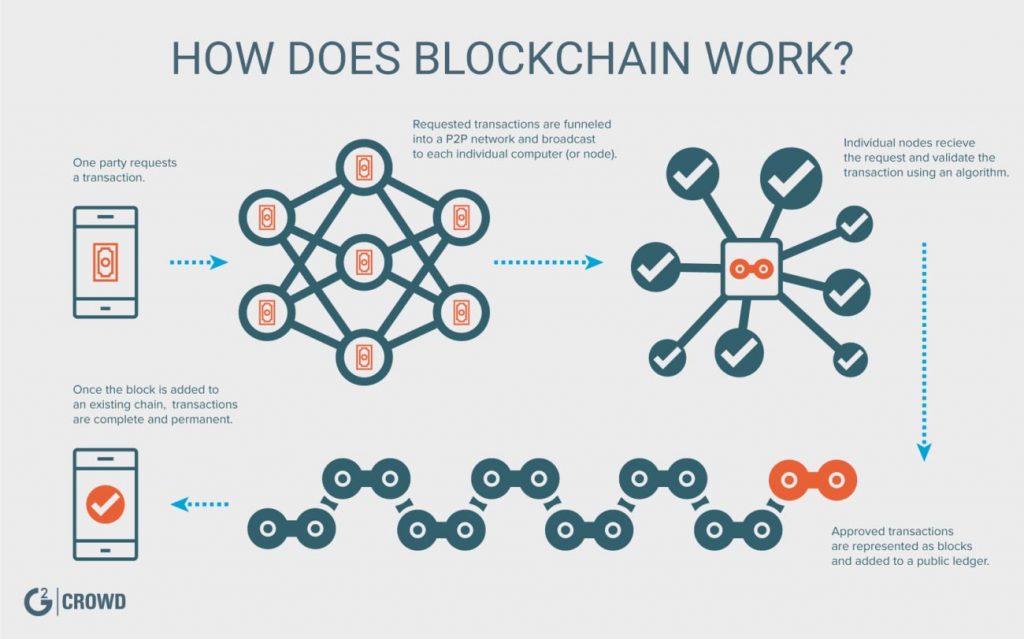

Bitcoin alsa known as btc, is the first cryptocurrency in the world. Bitcoin was designed by Satoshi Nakamoto as a system that can work without a central bank o a single system administrator. Bitcoin is a peer-to-peer system, from user to user, without the need for intermediaries. These transactions are verified by network nodes through cryptography and recorded in a public distributed ledger called a blockchain.

Blockchain

The blockchain is a public ledger that records bitcoin transactions. It is implemented as a chain of blocks, each block containing a hash of the previous block up to the genesis block of the chain. A novel solution accomplishes this without any trusted central authority: the maintenance of the blockchain is performed by a network of communicating nodes running bitcoin software. Transactions of the form payer X sends Y bitcoins to payee Z are broadcast to this network using readily available software applications.

Network nodes can validate transactions, add them to their copy of the ledger, and then broadcast these ledger additions to other nodes. The blockchain is a distributed database – to achieve independent verification of the chain of ownership of any and every bitcoin amount, each network node stores its own copy of the blockchain. Approximately once every 10 minutes, a new group of accepted transactions, a block, is created, added to the blockchain, and quickly published to all nodes. This allows bitcoin software to determine when a particular bitcoin amount has been spent, which is necessary in order to prevent double-spending in an environment without central oversight. Whereas a conventional ledger records the transfers of actual bills or promissory notes that exist apart from it, the blockchain is the only place that bitcoins can be said to exist in the form of unspent outputs of transactions.

Transactions

Transactions are defined using a Forth-like scripting language. Transactions consist of one or more inputs and one or more outputs. When a user sends bitcoins, the user designates each address and the amount of bitcoin being sent to that address in an output. To prevent double spending, each input must refer to a previous unspent output in the blockchain. The use of multiple inputs corresponds to the use of multiple coins in a cash transaction. Since transactions can have multiple outputs, users can send bitcoins to multiple recipients in one transaction. As in a cash transaction, the sum of inputs (coins used to pay) can exceed the intended sum of payments. In such a case, an additional output is used, returning the change back to the payer. Any input satoshis not accounted for in the transaction outputs become the transaction fee.

Transaction fees

An actual bitcoin transaction including the fee from a web based cryptocurrency exchange to a hardware wallet.

Paying a transaction fee is optional. Miners can choose which transactions to process, and they are incentivised to prioritize those that pay higher fees.

Because the size of mined blocks is capped by the network, miners choose transactions based on the fee paid relative to their storage size, not the absolute amount of money paid as a fee. Thus, fees are generally measured in satoshis per byte, or sat/b. The size of transactions is dependent on the number of inputs used to create the transaction, and the number of outputs.

Ownership

In the blockchain, bitcoins are registered to bitcoin addresses. Creating a bitcoin address is nothing more than picking a random valid private key and computing the corresponding bitcoin address. This computation can be done in a split second. But the reverse (computing the private key of a given bitcoin address) is mathematically unfeasible and so users can tell others and make public a bitcoin address without compromising its corresponding private key. Moreover, the number of valid private keys is so vast that it is extremely unlikely someone will compute a key-pair that is already in use and has funds. The vast number of valid private keys makes it unfeasible that brute force could be used for that. To be able to spend the bitcoins, the owner must know the corresponding private key and digitally sign the transaction. The network verifies the signature using the public key.

If the private key is lost, the bitcoin network will not recognize any other evidence of ownership; the coins are then unusable, and effectively lost. For example, in 2013 one user claimed to have lost 7,500 bitcoins, worth $7.5 million at the time, when he accidentally discarded a hard drive containing his private key. A backup of his key(s) would have prevented this.

Mining

Mining is a record-keeping service done through the use of computer processing power. Miners keep the blockchain consistent, complete, and unalterable by repeatedly grouping newly broadcast transactions into a block, which is then broadcast to the network and verified by recipient nodes. Each block contains a SHA-256 cryptographic hash of the previous block, thus linking it to the previous block and giving the blockchain its name.

To be accepted by the rest of the network, a new block must contain a so-called proof-of-work (PoW).The system used is based on Adam Back’s 1997 anti-spam scheme, Hashcash. The PoW requires miners to find a number called a nonce, such that when the block content is hashed along with the nonce, the result is numerically smaller than the network’s difficulty target. This proof is easy for any node in the network to verify, but extremely time-consuming to generate, as for a secure cryptographic hash, miners must try many different nonce values (usually the sequence of tested values is the ascending natural numbers: 0, 1, 2, 3, …) before meeting the difficulty target.

Every 2,016 blocks (approximately 14 days at roughly 10 min per block), the difficulty target is adjusted based on the network’s recent performance, with the aim of keeping the average time between new blocks at ten minutes. In this way the system automatically adapts to the total amount of mining power on the network. Between 1 March 2014 and 1 March 2015, the average number of nonces miners had to try before creating a new block increased from 16.4 quintillion to 200.5 quintillion.

The proof-of-work system, alongside the chaining of blocks, makes modifications of the blockchain extremely hard, as an attacker must modify all subsequent blocks in order for the modifications of one block to be accepted. As new blocks are mined all the time, the difficulty of modifying a block increases as time passes and the number of subsequent blocks (also called confirmations of the given block) increases.

Pooled mining

Computing power is often bundled together or “pooled” to reduce variance in miner income. Individual mining rigs often have to wait for long periods to confirm a block of transactions and receive payment. In a pool, all participating miners get paid every time a participating server solves a block. This payment depends on the amount of work an individual miner contributed to help find that block.

The successful miner finding the new block is rewarded with newly created bitcoins and transaction fees. As of 9 July 2016, the reward amounted to 12.5 newly created bitcoins per block added to the blockchain. To claim the reward, a special transaction called a coinbase is included with the processed payments. All bitcoins in existence have been created in such coinbase transactions. The bitcoin protocol specifies that the reward for adding a block will be halved every 210,000 blocks (approximately every four years). Eventually, the reward will decrease to zero, and the limit of 21 million bitcoins will be reached 2140; the record keeping will then be rewarded by transaction fees solely.

In other words, bitcoin’s inventor Nakamoto set a monetary policy based on artificial scarcity at bitcoin’s inception that there would only ever be 21 million bitcoins in total. Their numbers are being released roughly every ten minutes and the rate at which they are generated would drop by half every four years until all were in circulation.

Wallets

A wallet stores the information necessary to transact bitcoins. While wallets are often described as a place to hold or store bitcoins, due to the nature of the system, bitcoins are inseparable from the blockchain transaction ledger. A better way to describe a wallet is something that “stores the digital credentials for your bitcoin holdings” and allows one to access (and spend) them. Bitcoin uses public-key cryptography, in which two cryptographic keys, one public and one private, are generated. At its most basic, a wallet is a collection of these keys.

There are three modes which wallets can operate in. They have an inverse relationship with regards to trustlessness and computational requirements.

- Full clients verify transactions directly by downloading a full copy of the blockchain (over 150 GB As of January 2018). They are the most secure and reliable way of using the network, as trust in external parties is not required. Full clients check the validity of mined blocks, preventing them from transacting on a chain that breaks or alters network rules. Because of its size and complexity, downloading and verifying the entire blockchain is not suitable for all computing devices.

- Lightweight clients consult full clients to send and receive transactions without requiring a local copy of the entire blockchain (see simplified payment verification – SPV). This makes lightweight clients much faster to set up and allows them to be used on low-power, low-bandwidth devices such as smartphones. When using a lightweight wallet, however, the user must trust the server to a certain degree, as it can report faulty values back to the user. Lightweight clients follow the longest blockchain and do not ensure it is valid, requiring trust in miners.

Third-party internet services called online wallets offer similar functionality but may be easier to use. In this case, credentials to access funds are stored with the online wallet provider rather than on the user’s hardware. As a result, the user must have complete trust in the wallet provider. A malicious provider or a breach in server security may cause entrusted bitcoins to be stolen. An example of such a security breach occurred with Mt. Gox in 2011. This has led to the often-repeated meme “Not your keys, not your bitcoin”.

Physical wallets store offline the credentials necessary to spend bitcoins. One notable example was a novelty coin with these credentials printed on the reverse side. Paper wallets are simply paper printouts.

Another type of wallet called a hardware wallet keeps credentials offline while facilitating transactions.